Loan Options

We provide a variety of mortgage programs designed for everyone from first-time homebuyers to investors. Explore conventional, FHA, USDA, VA, and jumbo loans, each offering unique benefits to suit different purchasing needs. Find the ideal financing option to match your property buying goals.

Explore the right program that fits your needs

Conventional

A convenient program that has options for primary, second, or investment property purchases. Primary purchases can have down payments as low as 3%!

FHA

A government-insured program that allows down payments as low as 3.5%!

Jumbo

This program is for loan amounts that exceed maximum conforming loan limits.

USDA

A government loan program designed for more rural areas and are only available in certain locations, but has a 0% down payment!

VA

Reserved for our brave veterans, as well as active, or qualifying reserve soldiers, this program comes with wonderful advantages such as 0% down.

Down Payment Assistance

When available, these programs are a great tool to help with the initial costs and fees of purchasing a home, but require more qualifications than a traditional program.

Renovation

Get more than a home loan; get a makeover. The renovation loan is great for renovating homes.

*Borrower’s must qualify for the loan programs. Minimum down payments may result in mortgage insurance requirements.

Frequently Asked Questions

Have questions about the home financing process? We've compiled answers to some of the most common inquiries to help clarify your doubts and support your journey.

How do I know which loan type is right for me?

The right loan type depends on your financial situation, credit score, down payment capability, and whether you meet certain eligibility criteria for government-insured loans. We offer personalized consultations to help determine the best fit for your needs.

Can I buy a home with a low down payment?

Yes, several loan programs, such as FHA and USDA loans, are designed for buyers with lower down payments. Conventional loans also offer options for down payments as low as 3%.

What are the benefits of pre-approval?

Getting pre-approved for a mortgage provides a clear idea of what you can afford, strengthens your offer on a home, and speeds up the closing process, making you a more attractive buyer to sellers.

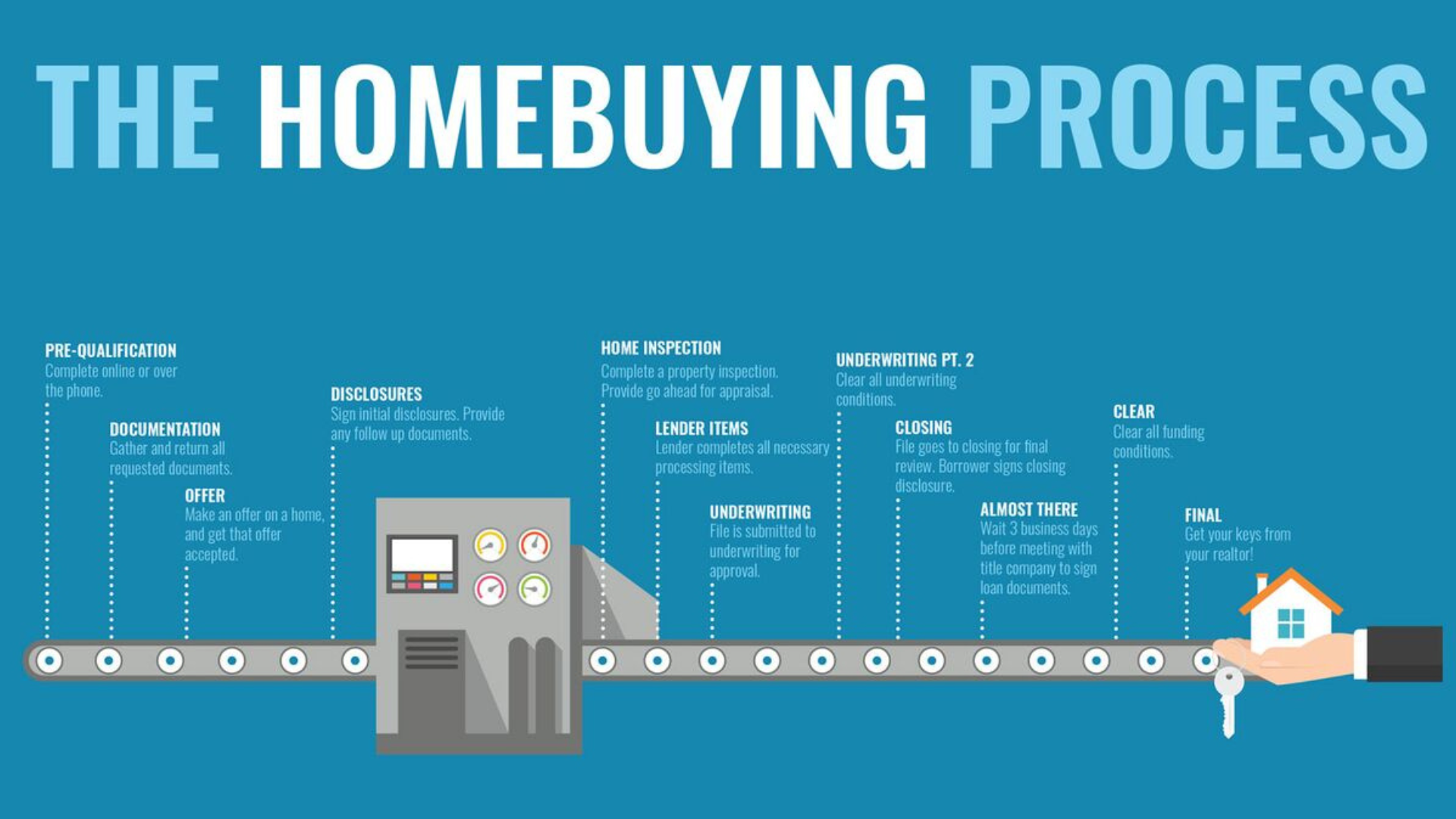

How long does the mortgage application process take?

The timeline can vary based on the loan type and individual circumstances but generally takes from 30 to 45 days from application to closing. We work diligently to ensure a smooth and timely process for each client.

Are there programs for first time homebuyers?

Yes, there are many programs available that offer low down payment options. For first time homebuyers looking for a primary residence, Conventional financing offers a 3% down payment option that requires the borrower take a home-buying education class.

Enjoy Your Fresh Start With Peace of Mind

Start Your Journey Today

Ready to explore your home financing options? Contact us to experience home buying with the care only family can provide. Together we will show you what’s possible!

Contact Information

4140 E. Baseline Rd. Ste 206 Mesa, AZ 85206 Company NMLS 160265

AZ - BK # 7548 CA - BK # 4130766 NM - BK # 03133 NV - BK # 5385

UT - BK # 9211514, Equal Housing Lender

Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act License #413-0766

Subscribe to our newsletter

Copyright © 2026 | Sun American. All Rights Reserved.